Farmily

Revolutionizing African Agriculture Through Blockchain Technology

$3,000,000

$2M Equity + $1M Debt

June 2025

Executive Summary

Key Highlights

- First comprehensive blockchain-powered agricultural trading platform in Africa

- Addresses $117B financing gap for agricultural SMEs

- EUDR compliance timing advantage (December 2025 deadline)

- Two-sided marketplace with multiple revenue streams

- Proprietary TRACE engine for automated compliance

- Path to $69.2M revenue by 2030 with 55% gross margins

$276B

Total Addressable Market

35,000

Target Farmers by 2030

$69.2M

Projected Revenue 2030

1,200

Commercial Farms by 2030

The Problem: African Agriculture Crisis

$117B Financing Gap

Agricultural SMEs lack access to affordable credit and financing solutions

Compliance Burden

New EUDR regulations require full supply chain traceability by December 2025

Fragmented Markets

Farmers lack direct access to buyers, leading to multiple intermediaries and reduced profits

Limited Transparency

Poor data visibility across the supply chain creates inefficiencies and trust issues

Only 10% of African farmers have access to formal financial services

Our Solution: Blockchain-Powered Agricultural Platform

Farmily's Integrated Platform

- FTC Trading: Direct farmer-to-buyer marketplace

- FT SaaS: Farm management and compliance tools

- FT Marketplace: Input financing and logistics

- TRACE Engine: Automated compliance and traceability

Blockchain Differentiation:

Immutable records, smart contracts for automated payments, and full supply chain transparency meeting EUDR requirements

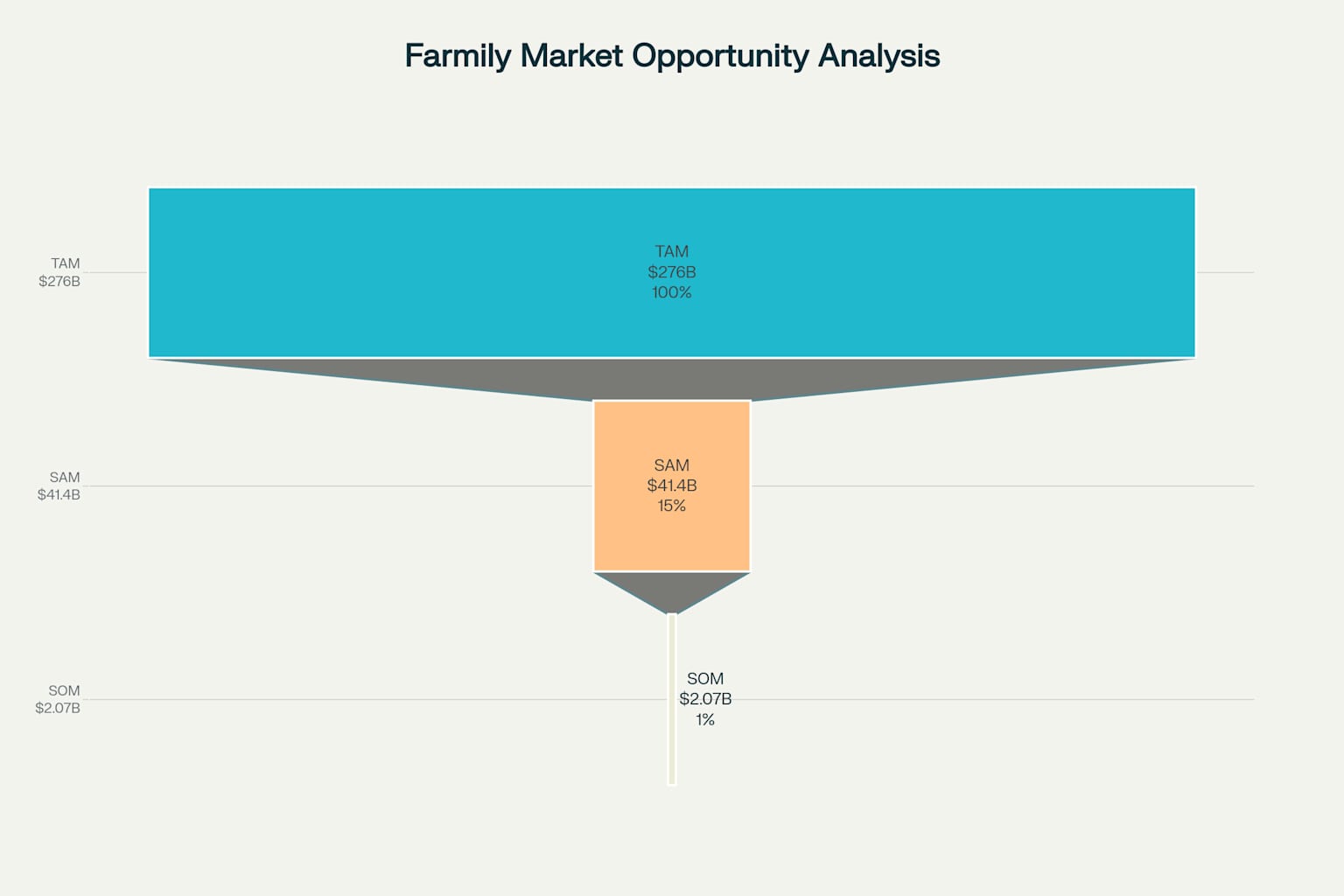

Market Opportunity: $276B African Agriculture Market

TAM/SAM/SOM Analysis

TAM: $276B

Total African Agriculture Market by 2030

SAM: $41.4B

Technology-enabled Agricultural Trading

SOM: $2.07B

Realistic Market Capture (5% of SAM)

Key Market Drivers:

- Growing population demanding food security

- Digital transformation in agriculture

- Regulatory compliance requirements (EUDR)

- Climate change adaptation needs

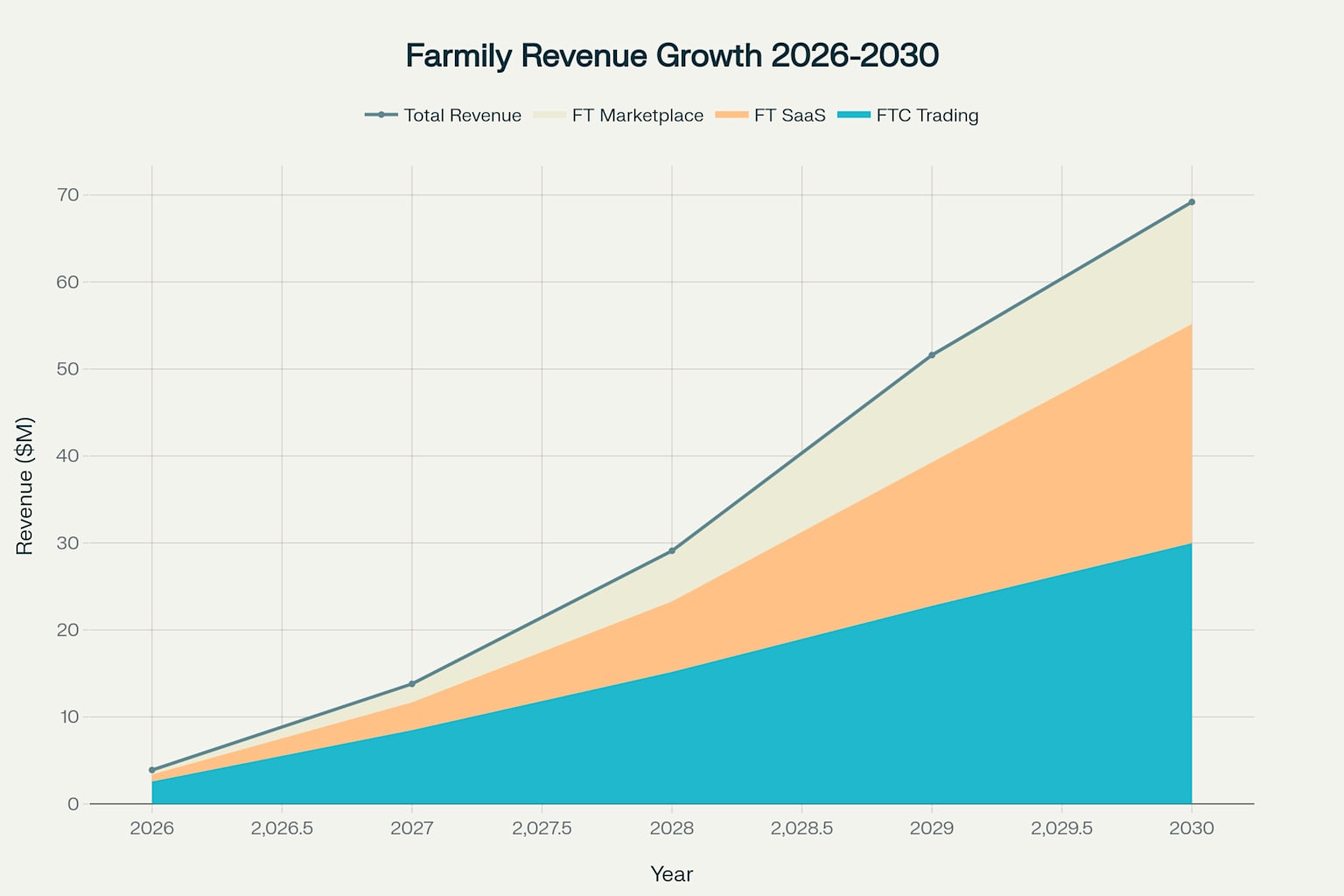

Revenue Model: $69.2M by 2030

Diversified Revenue Streams

FTC Trading (43%)

2-3% commission on commodity trades

FT SaaS (36%)

$20-50/month subscription fees

FT Marketplace (21%)

5-8% fees on input sales

Strong Unit Economics

- 55% gross margin target

- $850 average revenue per farmer

- 18-month payback period

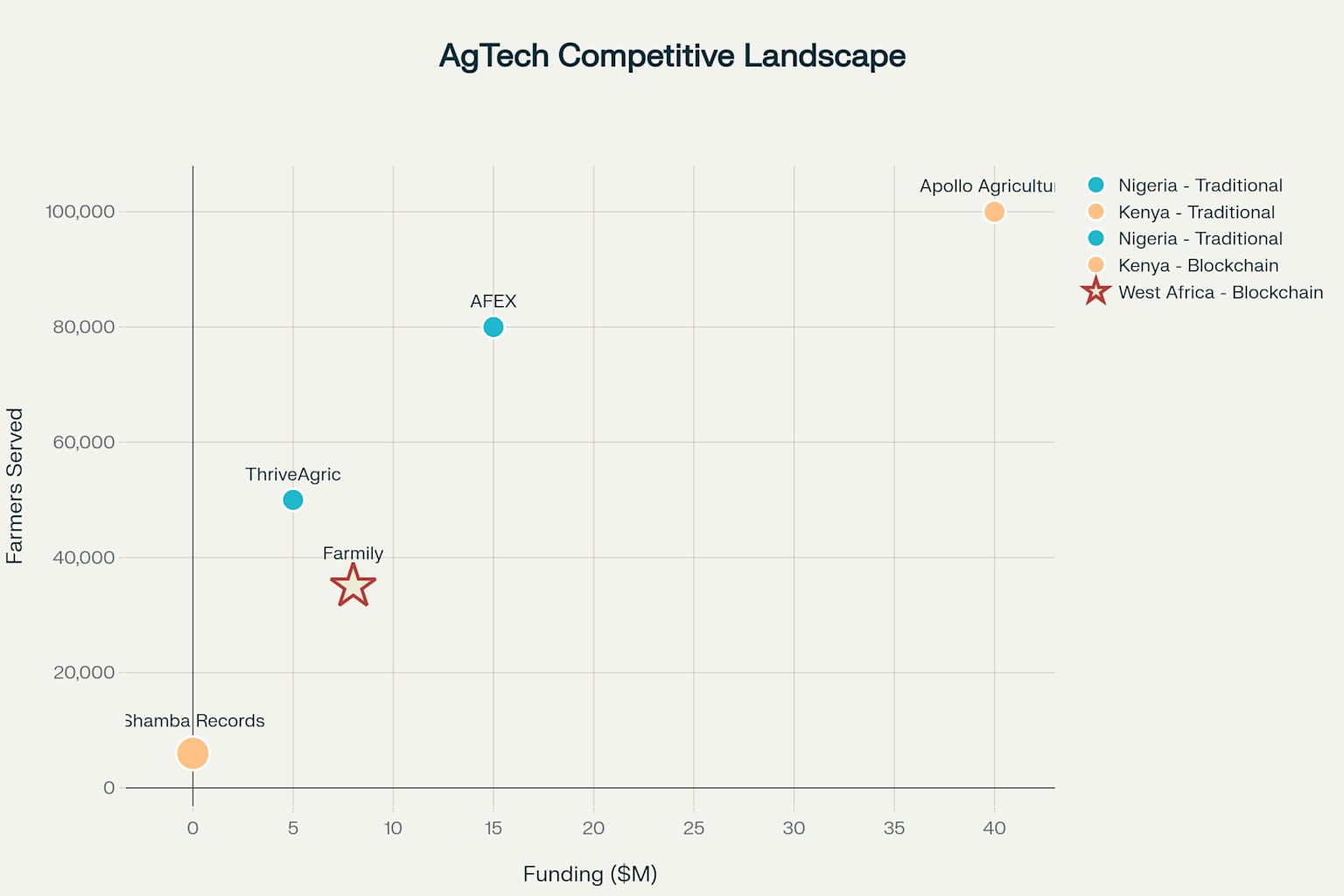

Competitive Landscape: Unique Positioning

Key Differentiators

🔗 Only Blockchain-Native Platform

Full traceability and smart contract automation

📋 EUDR Compliance Ready

First-mover advantage with automated compliance

🔄 Full-Stack Solution

Complete ecosystem from farm to market

Competitive Comparison

| Company | Funding | Farmers | Blockchain | EUDR Ready |

|---|---|---|---|---|

| Farmily | $3M (Target) | 35K (Target) | ✓ | ✓ |

| AFEX | $42M | 80K | ✗ | ✗ |

| Apollo Agriculture | $10M | 100K | ✗ | ✗ |

| ThriveAgric | $58.5M | 50K | ✗ | ✗ |

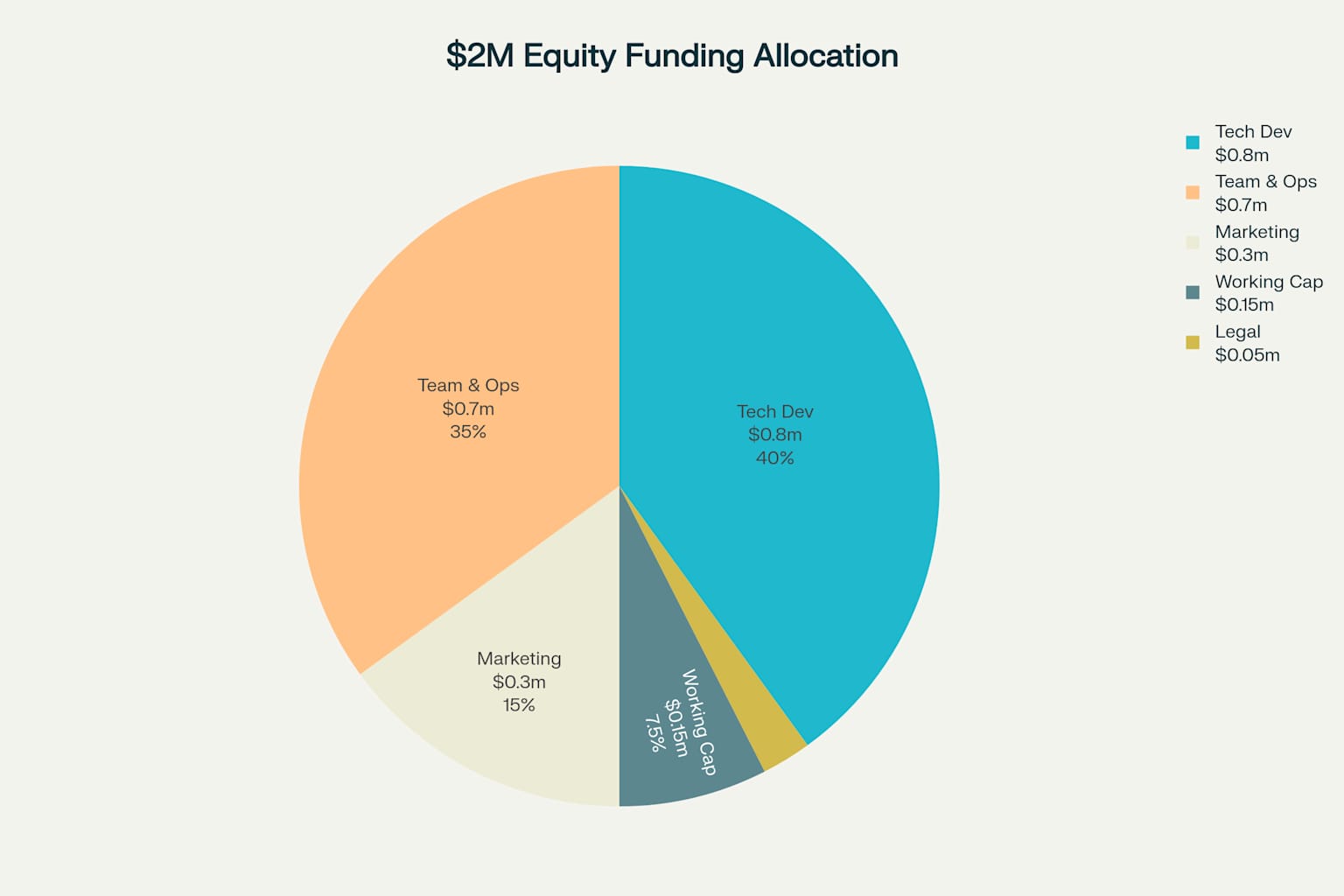

Use of Funds: Strategic Investment Allocation

$2M Equity Funding Allocation

Technology Development

- TRACE engine enhancement and scaling

- Mobile and web platform development

- AI/ML integration for predictive analytics

- API development and third-party integrations

Team Building & Operations

- Hire key technical and business development staff

- Expand operations team across 3 countries

- Sales and customer success teams

- Operational infrastructure setup

Marketing & Customer Acquisition

- Digital marketing and brand building

- Field marketing and farmer education

- Partnership development

- Trade shows and industry events

$1M Debt Financing

Working capital facility for trade financing and inventory management

Investment Terms & Timeline

Funding Structure

Total Funding

Equity Portion

Debt Facility

Valuation

Equity Stake

Use Period

Funding Timeline

Phase 1: Immediate (Q3 2025)

Initial funding for team expansion and market launch

Phase 2: Milestone-Based (Q4 2025)

Upon achieving 500 active farmers and $100K MRR

Phase 3: Debt Facility (Q1 2026)

Trade financing facility activated with revenue growth

Thank You

Ready to Transform African Agriculture

$3M Investment

For blockchain-powered agricultural platform

$69.2M Revenue

Projected by 2030 with 55% margins

35,000 Farmers

Empowered through technology